It’s no secret that college expenses add up quickly. Nowadays, paying for college takes time and careful consideration of a family’s finances. Good news is there are plenty of saving plans available to help pay for college – the most popular one being the 529 Plan. The biggest appeal of the 529 Plan is it offers tax free growth when used to fund qualified higher education and high annual contribution limits. However, there are a few scenarios (one in particular) where a Traditional or Roth IRA may be a viable option to consider.

The most common scenario occurs when there hasn’t been any money set aside for your child approaching college – not in the budget, simply overlooked, unsure of a college savings account benefits, or any number of other reasons – but you have an IRA or Roth IRA account and you feel it’s important to help your child pay for their college education.

In this case, there is an exception that allows IRA distributions for qualified higher education expenses like tuition, books, supplies, fees and room and board, etc. as long as the student is enrolled in a degree program. This exception allows you to avoid the 10% early withdrawal penalty on IRA distributions if you are under the age of 59.5. If you are older than 59.5, this exception does not apply to you as there no penalties to withdraw from your IRAs at that age.

Balances in IRAs and Roth IRAs are not used for financial aid need analysis purposes and should not affect financial aid eligibility. However, withdrawals from IRAs are generally treated as income and may affect eligibility. Even withdrawals from Roth IRAs are treated as untaxed income and may affect needs based financial aid eligibility the year following the withdrawal.

So basically you have a traditional IRA being used as a tax-deferred college savings vehicle. If you are able to limit your withdrawals from a Roth IRA to contributions only, the distribution is not only tax free, but penalty free as well when used for qualified higher education expenses.

I want to emphasize that prior to considering this option, it is absolutely imperative you thoroughly review your finances to make sure this will not put your financial future and retirement plans at risk. I’m not an advocate of borrowing or withdrawing from retirement accounts for any reason outside of providing for life in retirement, and I strongly advise against placing your financial future in jeopardy to fund your child’s college education. I have seen this happen far too often with very poor outcomes – becoming a financial burden to the kids later on, pushing back retirement or worse, not being able to retire at all. I have also seen folks withdraw significant portions of their IRAs to fund their kid’s college, only to see them drop out.

To be clear, I am not suggesting student loans. However, the fact is students can borrow money for college and there are no retirement loans available, as far as I know. If your child needs to take out a loan, by all means consider helping them pay off their student loans once completing their education. Whatever you decide to do, make sure you prioritize evaluating the long term effects this will have not only on your finances, but theirs as well.

Other important considerations include:

- Distribution and expenses must happen in the same years

- Qualified educational expenses can only be used towards one educational tax benefit (no double dipping!) Ex: you can’t take a penalty-free IRA withdrawal and use the same expense toward a Lifetime learning tax credit.

- You can’t replenish the funds you withdrew from your IRA account except by normal annual contributions, which are subject to annual limits

If you’d like to discuss your options, book a call using this link and we’ll be in contact with you shortly.

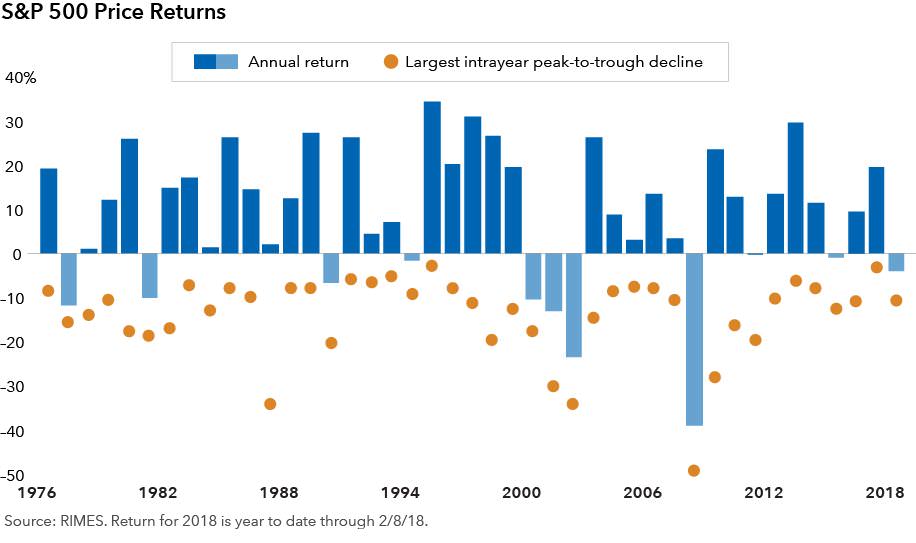

By all accounts it has been a phenomenal run for stocks. Through the end of 2017, the S&P 500 has had a positive total return in 19 of the last 20 quarters. The S&P 500 recorded a loss of 0.8% in the first quarter of 2018. This is the ninth time since 1990 that the stock market was negative during the first three months of the year. The S&P 500 went on to record a positive return for the entire year in five of the previous eight years that started with a loss (1992, 1994, 2003, 2005 and 2009) and suffered full-year of losses in the other three years (1990, 2001 and 2008).

It’s also clear that market volatility is back in 2018 versus the remarkably low volatility we experienced in 2017. To put things into perspective, the S&P 500 in 2017 had a total of nine 1% gain or loss trading days. In the first quarter of 2018 alone, the S&P 500 has had more than 20 1% gain or loss trading days. Given the uptick in volatility and panic inducing, sensationalized media coverage, I would like to provide you with three tips to help you stay focused on your long term goals and avoid undue stress that can accompany short term declines in the market.

1. Tune out the news and don’t act on emotion

In case you didn’t know, the news media outlets may not have your financial interest in mind. Their goal sometimes is to keep you in fear and tuned in for better ratings. Market pull backs are normal and should be expected in exchange for the opportunity of achieving long term growth.

As demonstrated by Nobel Prize-winning psychologist, Daniel Kahneman, loss-aversion theory says that people feel the pain of losing money more than they enjoy gains. Naturally, investors flee the market during sudden, sharp declines and in the same way, greed motivates them to jump back in when stocks are on the rise. Both of these natural impulses can be devastating to your long term goals, but investments rooted in proper education, unbiased research and proven strategies can overcome the impulse and pull of emotion.

Below is a chart showing intra-year declines (orange dot) of the S&P 500 as well as annual year end returns (blue bar):

2. Change your investments proactively, not during market declines

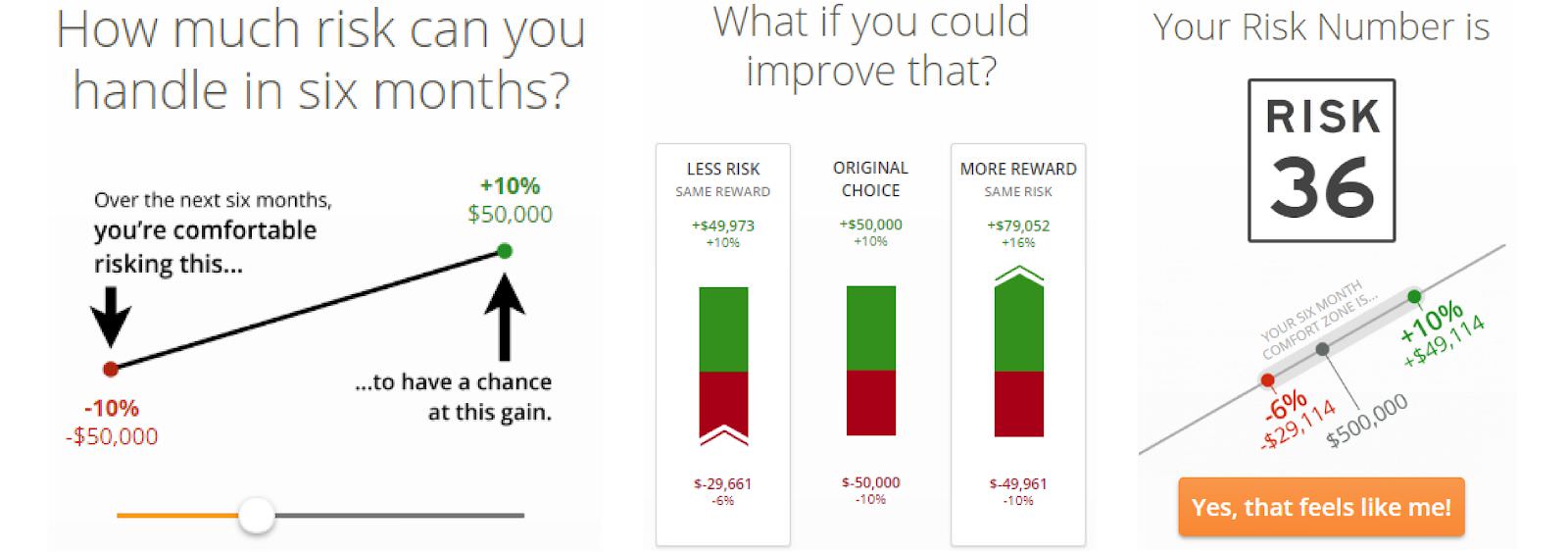

Riskalyze Services are for informational purposes only and do not constitute investment advice or an investment recommendation.

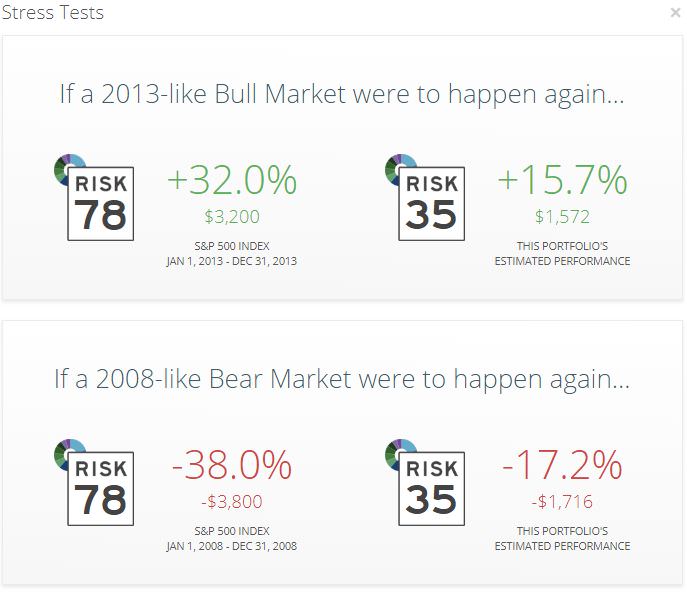

Ideally, you have taken the time to properly assess your risk tolerance and aligned your investments (as shown above) with your ability to endure volatility. If done properly, the ups and downs in your portfolio shouldn’t cause you to have a knee jerk reaction at inopportune times. I recommend stress testing your portfolio to see how it may have performed in both good and bad years.

Below is an example of a stress test:

Riskalyze Services are for informational purposes only and do not constitute investment advice or an investment recommendation.

3. Be patient, your investments may thank you later

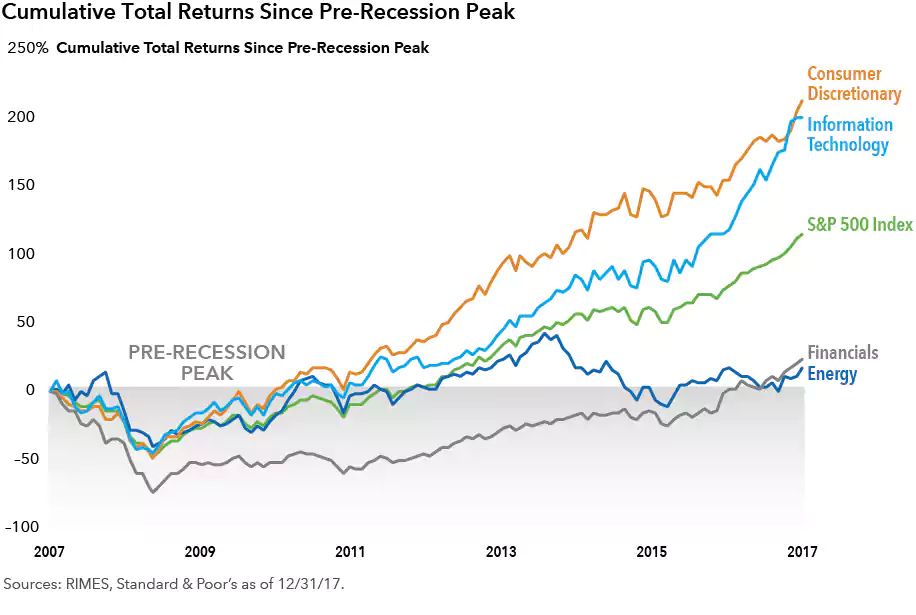

It is almost impossible for anyone to accurately predict short-term market moves, and investors who sit on the sidelines risk losing out on periods of meaningful price appreciation that may follow sharp market downturns. The visual below shows how allowing emotion and impatience to dictate your investment decisions can affect your long-term financial goals.

Many let emotion get the best of them during the 2008 and 2009 market downturn causing them to sell investments in their retirement accounts resulting in significant losses. Moreover, many did not reinvest for several years and missed out on several high growth years that followed.

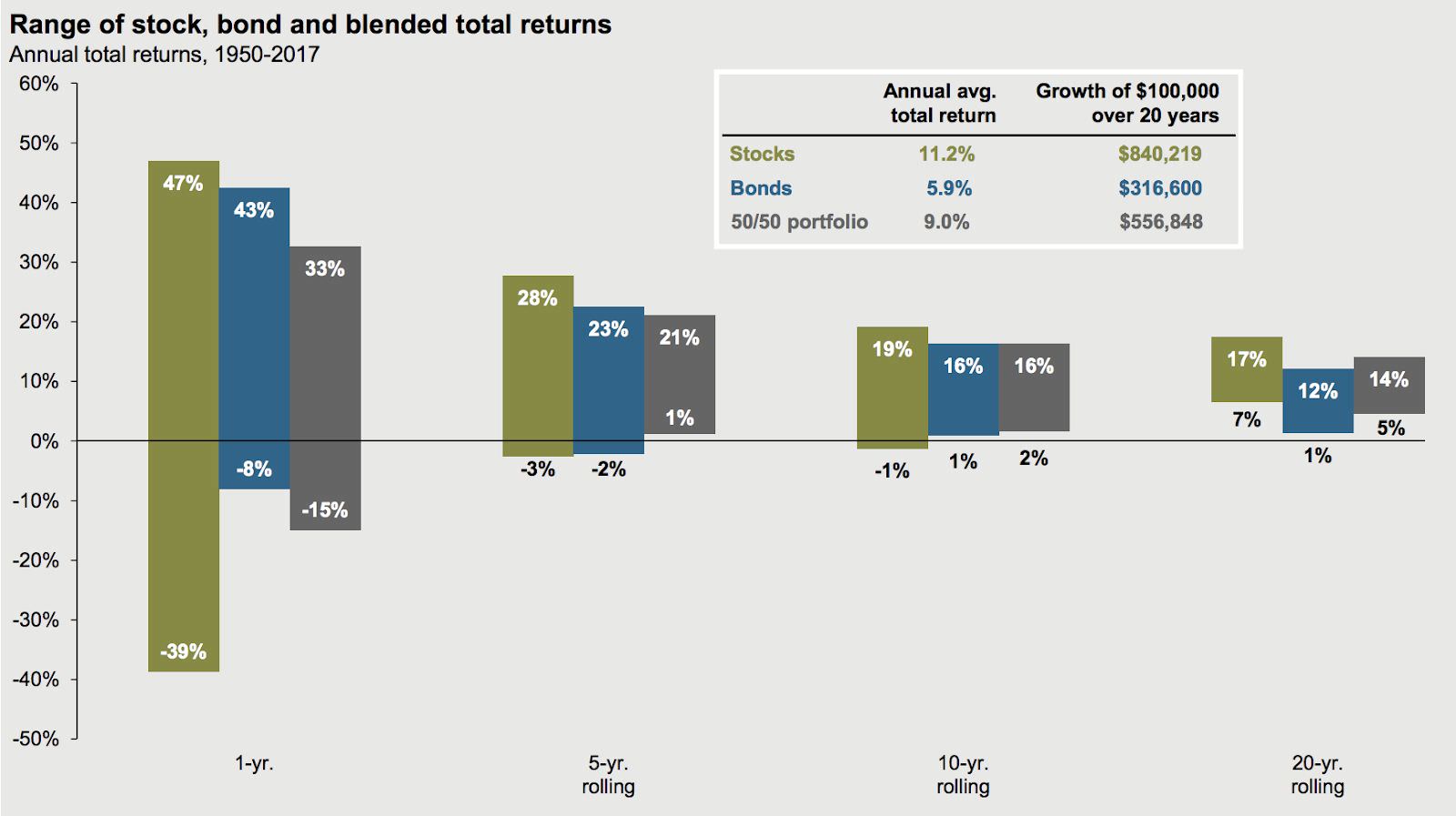

This chart clearly illustrates how patience pays. One year losses are common, however; a blend of stocks and bonds have not suffered a negative return in any five-year rolling period. This information does not imply that all future five-year rolling periods will mirror the past. However, understanding historical market data is a powerful tool to “fight the fear” that market volatility can bring about. Past performance does not guarantee future results.

Source: Barclays, Bloomberg, FactSet, Federal Reserve, Robert Shiller, Strategas/Ibbotson, J.P. Morgan Asset Management. Returns shown are based on calendar year returns from 1950 to 2017. Stocks represent the S&P 500 Shiller Composite and Bonds represent Strategas/Ibbotson for periods from 1950 to 2010 and Bloomberg Barclays Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950 to 2017. Guide to the Markets – U.S. Data are as of March 31, 2018. Past performance doesn’t guarantee future results. Examples are for illustrative purposes only. Riskalyze Services are for informational purposes only and do not constitute investment advice or an investment recommendation. Riskalyze Services are for informational purposes only and do not constitute investment advice or an investment recommendation.

The Overview

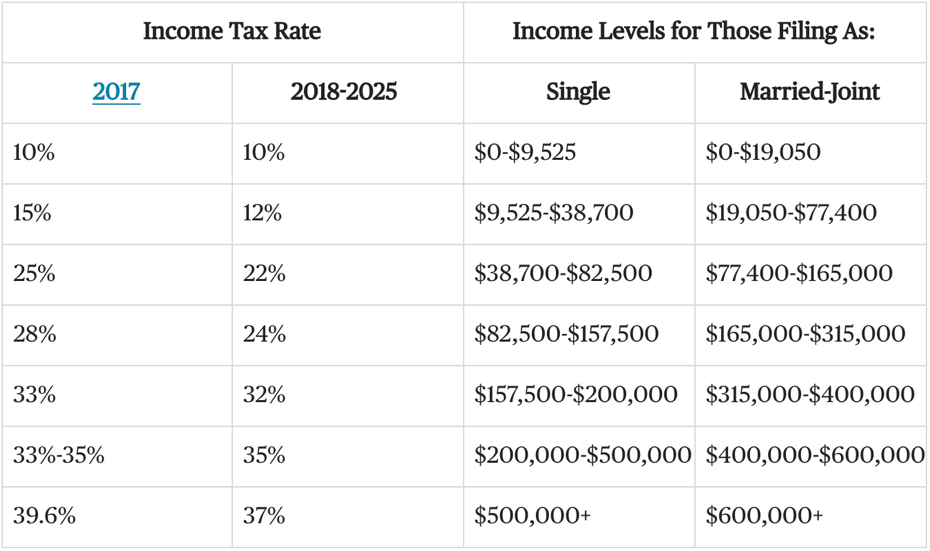

The U.S. Senate recently passed a new tax bill titled, “Tax Cuts and Job Act”. President Donald Trump signed this bill, stating that it will be beneficial both to individuals and corporations. The bill will go into effect for 2018 taxes, bypassing 2017 taxes.

The Breakdown

The bill has a wide range effect, impacting all taxpayers to a varying degree. As always, your income will significantly impact your taxes – those in higher tax brackets will feel a bigger impact. However, there are many tax brackets that are lowering.

Analysts have noted that the standard deduction will nearly double for many households, which means many will opt to take that rather than itemize their taxes in the coming years. In addition, the child tax credit for each child under the age of 17 has significantly increased from $1,000 to $1,600 per child. It’s also important to note that the personal tax exemption has been eliminated under this new tax bill, which could be a setback for some households.

The Implications

If you’re anything like me, hearing the news of a new Senate Tax Bill brought one question to mind, “What does this mean for me, specifically?”

The Balance explains the bill well,

“The Act keeps the seven income tax brackets but lowers tax rates. Employees will see changes reflected in their withholding in their February 2018 paychecks. These rates revert to the 2017 rates in 2026.

The Act creates the following chart. The income levels will rise each year with inflation. But they will rise more slowly than in the past because the Act uses the chained consumer pride index. Over time, that will move more people into higher tax brackets.”

The article goes on to explain,

“The Act lowers the maximum corporate tax rate from 35 percent to 21 percent, the lowest since 1939. The United States has one of the highest rates in the world. But most corporations don’t pay the top rate. On average, the effective rate is 18 percent.”

Hopefully this helps you get a sense of how you’ll directly be affected. Please feel free to contact us if you’d like to further discuss the bill and how it specifically affects you.

Save Now, Then Save Some More!

We all know that saving for retirement is important, and it’s never too early to start. However, it never feels as simple as putting money aside – there’s always something that gets in the way. Whether it’s loans or debt that’s holding you back, is it better to pay off what you owe first or prioritize saving for your retirement account?

The Million Dollar Question

Building your retirement savings account is critical, but at what cost? Most of us enter the working world with some level of student loan, not to mention the possibility of developing more down the road – car loans, credit card debt, etc. – yet we’re being told to start saving for our retirement as soon as possible.

So how do you balance paying off owed money and simultaneously save for the future?

The Balance

As a financial advisor, I’m a strong advocate for saving for retirement as much as you can as fast as you can. That being said, I firmly believe the priority is to pay off your debt first, particularly the ones with high interest rate.

If you have high interest debt, then the amount you’re losing in interest each month may be more than what you could be earning in compound interest in savings.

I often tell my clients that once they’ve paid off high interest rate debt, then they can start contributing to their retirement savings account. This, of course, will look different case by case, but never rule out saving for retirement just because you owe money! Prioritize paying off your debt now as a way of being proactive about your future. The better you plan, the better you retire – and therein lies the balance.

Don’t Take My Word for It

Forbes weighed in on this topic as well,

“While this question is best put to a financial planner who can look at your entire financial picture, one way to think of it is that, if your student loan interest rate is 6.8%, the payments you make toward those loans give you a guaranteed 6.8% return on your money. Your retirement investments, especially after accounting for inflation, may not do as well. On the other hand, if you’re 50 and are behind on saving for retirement, you’ll still want to get the ball rolling since time is the biggest factor in how much your investments can grow. Bera says that for any debts with interest rates above 6%, she favors paying down debt over saving for retirement, but once you eliminate all those and are left with debts with lower interest rates, the emphasis would swing back to retirement.”

Low interest debt that’s tax deductible, like a mortgage, doesn’t need to be paid off before saving for retirement. However; I recommend you pay off all other high interest debt first, and then you can begin contributing the maximum to your retirement savings account.

If you’d like personalized advice on how much you should be paying/saving, one of our advisors will be happy to sit down with you and strategize how to get you on track for your best retirement.

Please schedule a call with us here if you would like to discuss your options.

Big News from the IRS

After two years without any changes, the IRS announced they will be increasing the 401(k) contribution limits for 2018. This is exciting news!

The increase in cost of living will allow individuals to contribute up to $18,500 ($500 increase) per year to their 401(k) retirement plan. Additionally, this increase will apply to other retirement accounts including 403(b) plans, most 457 plans, and Thrift Savings Plans (TSPs), however; the IRA and Roth IRA account contribution limits will not change. All employees should expect to see notifications from their employers about this increase.

Will This Really Make a Difference in the Long Run?

I always tell my clients that in order to grow their retirement savings significantly, they need to contribute as much as possible as young as possible. While an additional $500 per year may not sound like a major increase, ultimately these contributions will add up to a lot come retirement.

CNBC notes the significant difference of increasing your contribution to $500 each year, rather than simply putting an additional $500 in your savings account,

“As personal finance site NerdWallet points out, it could mean up to $70,000 more in your retirement account. The site calculated how much bigger your retirement fund would get if you started investing an additional $500 a year. It assumed a retirement age of 67 and a 6 percent annual rate of return. To give you an idea of just how powerful compound interest is, NerdWallet also highlighted how much money you’d have if you didn’t invest the $500 a year and simply kept it as cash:

- If a 30-year-old starts investing an extra $500 a year, it could mean an extra $70,212 in retirement, versus $18,500 saved in cash.

- If a 40-year-old starts investing an extra $500 a year, it could mean an extra $34,712 in retirement, versus $13,500 in cash.

- If a 50-year-old starts investing an extra $500 a year, it could mean an extra $15,202 in retirement, versus $8,500 in cash.”

How the Increase Positively Impacts Your Taxes

In addition to increasing your retirement savings, your taxable income will also be reduced when you contribute the additional $500.

If you have an employee contribution matching plan, a good rule of thumb is to contribute the maximum matching amount so you take full advantage and not leave any money on the table. However, if you can contribute more and maximize your 401(k) contributions each year (coupled with compounding interest), you’ll have a much larger retirement savings account.

Schedule a free call with us today if you have any questions regarding the increase in 401(k) contribution limits for 2018.