It’s hard to believe it’s been two whole years since Covid first came to town, leaving a whirlwind of confusion in its wake. So much has changed in our lives due to the virus, and if you’re wondering when things will get back to normal, you’re definitely not alone.

For many people, the biggest challenge of the pandemic was financial. With the initial shut-down, it was hard to know how the economy — and more personally, your boss or business — would fare. A lot has changed since those first quarantine weeks in March 2020 — has your financial plan kept up?

The standard advice is to review your financial plans whenever you experience a major life change. Usually this means something like a marriage, divorce, birth of a child, new job, or inheritance. We think that the pandemic should definitely count as a major life event! Here’s what to consider moving forward.

Unemployment

If you were laid off temporarily or permanently during the pandemic, your finances have almost certainly taken a hit. If you find yourself with significantly reduced income, you’ll want to review your budget to cut spending and adjust your savings plan to match your new circumstances.

If you are currently or have in the past been able to collect unemployment benefits, remember that the federal government counts UI as income — and they tax it. If you haven’t elected to have those taxes withheld from your benefits, you could find yourself owing the IRS money when you file your tax return this year. Fortunately, the IRS offers a payment plan to help make an unexpected tax bill more manageable.

Career Change

Many people took pandemic job interruptions as an opportunity to make a career change, either by seeking a new job or by going back to school for training in a new area. If you’re in the middle of a major shift in your working life, take the time to research typical salaries and benefits in your new field. This information will help you plan ahead with a new budget so you can adjust your lifestyle accordingly.

Planning for major benefits changes can be trickier. If you’re thinking of starting your own business or becoming an independent contractor, you’ll need to research the cost of exchange-purchased health insurance and budget for that expense. You’ll also want to explore your retirement plan options and open an IRA if you’ll no longer have a company-sponsored 401(k).

Once you’ve transitioned into your new position, you’ll also want to consolidate any old retirement plans you had with your previous employer by completing a rollover to your new retirement fund. This will let you track and manage your money more easily and is a tax-free maneuver — as long as you follow the rules when you make the shift.

Early Retirement

If you were close to retirement age when Covid hit, the pandemic may have forced you to seriously think about retiring early. Can you afford to do so? This is a complex question that requires significant planning and some mathematical calculations to figure out. This is best done with a professional who can help you calculate how long your nest egg is likely to last, the tax implications of retiring early, and the effect of an early retirement on your Social Security income and/or pension plan. Working part time can also affect these benefits, so it’s important to run the numbers on various scenarios to understand all the consequences.

You’ll also need to develop an effective plan for withdrawing your retirement income. This isn’t as simple as taking money out of a savings account, because you’ll want to sell off your investments in the most efficient way. For example, you may want to avoid selling stocks when their prices are low, because you’ll be stuck locking in lost value. A fiduciary is a good resource to ask for help with all the moving parts required to make an early retirement work for you.

Moving On

Whether you struggled during the pandemic or found yourself with a little extra money thanks to stimulus payments and spending less, moving forward from the pandemic into the rest of your life requires a good financial plan. No matter where you are right now, follow these steps to make sure you’re future is on track:

- Review your household budget to make sure current spending works with current income.

- Automate retirement savings based on your current income — review and adjust this amount to match your current situation.

- If you had to pause savings during the pandemic, review your budget now to see if you can play catch up. Even increasing your monthly savings by a little bit will help you get back on track.

- If you have extra money from stimulus, tax credits, or an unused travel fund, put it to good use! Invest this money in something better than an almost 0-interest savings account.

For help developing your post-pandemic financial plan, give us a call! We’re excited to work with you on developing a just-right savings and retirement strategy — one that reflects your new reality, goals, and dreams.

The economy can feel like an impossibly complex thing. After all, there are so many moving parts: real estate, inflation, the stock market, government decision making — and all of it is intertwined.

Right now, the economy is in flux. This is the natural result of the global pandemic, which set off a series of unprecedented events that changed the way money and goods flow. You’ve probably already noticed the effect of inflation driving up prices at the grocery store. Governments have taken note of inflation as well, and now the Federal Reserve is about to take steps to try to slow down inflation by raising interest rates.

What do rising interest rates mean for the rest of the economy — and possibly for your wallet? Let’s break down some of the basics.

Why Raise Interest Rates at All?

The Federal Reserve sets the Federal Funds Rate, which is the amount that banks charge each other to borrow money. This rate affects the cost of all other borrowing and lending throughout the US economy, because all interest rates are based on this one. Right now, the federal interest rate is very low, because the Fed wanted to make it cheaper and easier for businesses to borrow money and grow during the pandemic.

However, when inflation rises too fast, it often makes sense for the Federal Reserve to try to slow the economy down a bit. That slower growth will help rein in inflation so it doesn’t outstrip wages and leave the average person struggling to make ends meet. Raising interest rates makes it more expensive to borrow money, but also more lucrative to invest it. Right now, the main goal of raising the interest rate is to slow inflation.

Rising Interest Rates and the Stock Market

The news media likes to report on big spikes and drops in the stock market because they make for exciting headlines — and often, these changes accompany an announcement from the Federal Reserve about their interest rate intentions. In the short term, the stock market will often react to rising interest rates with a sell-off, and to falling interest rates with a quick spike in value.

That means that rising interest rates are bad for the stock market, right?

Not exactly. When you zoom out and look at the long term, periods of rising interest rates actually correlate to a strong stock market. Since 1989, the average rate of return on the Dow Jones Industrial Average during rising interest rate periods was +55%, compared to just +23% growth during periods of falling interest rates. Notice here that growth occurred whether interest rates rose or fell — and it actually did better when interest rates were going up.

Rising Interest Rates and Real Estate

When the Fed raises interest rates, it has a direct impact on anyone with a Home Equity Line of Credit (HELOC) or an Adjustable Rate Mortgage (ARM). That’s because the interest rates on these loans change month to month and are based on the Fed’s interest rate. If you have outstanding debt on a HELOC or ARM, your interest rate — and relatedly, your minimum payment and total amount of money and time to pay off your balance — will rise as well.

For home buyers and sellers, rising Federal interest rates don’t always mean a rise in fixed mortgage rates. If mortgage rates do rise, the general wisdom is that the housing market should slow a bit. This means that home prices should rise more slowly than in the past, though they may not actually fall. This is generally still good news for sellers, though first-time buyers could still struggle to enter a hot real estate market.

Rising Interest Rates and Consumer Spending

In general, rising interest rates tend to lead to lower consumer spending overall. This is especially true for larger purchases that buyers would use credit to cover. Loan rates and credit card interest rates will all rise along with the Fed’s benchmark, so borrowing money for big purchases will be more expensive.

This is especially important for credit card users, who could see their interest rates rise. While credit card companies can’t raise the interest on balances for things you’ve already purchased, they only need to provide 45 days notice to raise your interest rate for future purchases. This will cause many consumers to re-evaluate their spending and delay unnecessary purchases.

The Bottom Line

Change can be scary, and daily headlines about the economy are designed to get your attention — often by highlighting the negative. But the Federal Reserve’s decision to raise interest rates doesn’t mean the economy is falling apart. On the contrary, these changes can often be good for investors who have a solid plan.

Need help getting that plan in order? We’re here for you! Contact us today to review your investment strategy and make sure your retirement plan is on track — no matter what the economic forecasters are predicting.

If you’ve been diligently saving money for your retirement, congratulations! Building your nest egg is a big deal, and the more effort you put into your planning now, the more likely you’ll be to enjoy your retirement years without worry.

But saving money is only half the battle. A good retirement plan also means figuring out the best way to use all the money you’ve saved once you retire. Taking distributions, or withdrawals, from your retirement account comes with its own set of rules, and you’ll want to get familiar with them to make sure you’re making the best possible choices about your money.

What Are Required Minimum Distributions?

Many people are surprised to learn that they must take distributions from their retirement accounts when they reach a certain age. Your required minimum distribution (RMDs) is the amount of money you are forced to take out of your qualified retirement account each year. RMDs are enforced by the IRS and are designed to keep people from hoarding money in tax-advantaged accounts — the government would like to collect taxes on that money at some point.

If you turn 70 before July 1, 2019, you must begin to take RMDs from your retirement account at age 70½. If you turn 70 on July 1, 2019 or later, you must begin to take RMDs at age 72.

Most, but not all, retirement accounts are subject to RMD rules. If you have any of the following, you’ll have to make withdrawals once you reach age 70½ or 72:

- Traditional IRA

- SEP IRA

- SIMPLE IRA

- 401(k)

- 403(b)

- 457 plans

- Profit-sharing plans

- Thrift Savings Plan

- Other defined contribution plans

The only type of retirement account that is not subject to RMD rules is a Roth IRA. In that case, distributions are only required upon the death of the account holder.

If you fail to make withdrawals from your qualified retirement account according to RMD rules, you could be subject to a severe tax penalty: a 50% excise tax on the amount you failed to distribute.

Calculating Your Required Minimum Distribution

Each year, you’ll need to calculate your RMD, to do this, you’ll take your IRA balance as of December 31 of the previous year and divide it by your distribution period. The distribution period is a number determined by the IRS and based on your current age. You can find it on the IRS RMD worksheet. You can also use an RMD calculator to get a quick overview of your distributions over the entire course of your retirement.

When you complete the math above, the amount you get is what you need to withdraw and pay taxes on for the current tax year. This amount will be different each year, depending on your age and the amount you have left in your retirement account.

Planning for Required Minimum Distributions

For many people, RMDs may not have a huge impact on your retirement plan. You simply take out at least the amount required, pay taxes on it, and you’re done. But if you have several different retirement accounts, you’ll need to track your RMDs for all of them, which can make planning more complex. What’s more, RMDs can force you to pay more in taxes that you may have been planning on, so it’s important to have a clear picture of all of your assets as you convert them to income while you’re retired.

In addition to increasing your tax burden during retirement, RMDs can also impact your Medicare premiums. For those with higher incomes, Medicare Part B and Part D plans are adjusted so that you pay more in premiums once your income reaches a certain amount. These IRMAA charges can sneak up on you if your RMDs push your income beyond $88,000 per year for single filers or $176,000 for married filers. If this happens to you, you’ll need to plan ahead for higher Medicare costs.

RMDs can also force you to sell off some investments at a loss if you’re not careful. To avoid this situation, it’s a good idea to make sure that a portion of your IRA is in a stable, fixed investment that you can easily sell to when you need to cash out. This will help you avoid locking in losses in down years.

Many people need their RMDs to live on throughout retirement, so they don’t feel concerned by the rule. But if you have a pension or other income and would prefer to avoid taking RMDs, you might consider converting some of your traditional retirement fund into a Roth IRA. You’ll still have to pay taxes on the money immediately with a Roth conversion, but this may still be worthwhile if you’re looking for a way to preserve your estate for your heirs. Likewise, the temporary increase in your income as a result of a Roth conversion could push you into an extra IRMAA charge for Medicare, so it’s a good idea to speak to a professional to plan when to complete a Roth conversion to make sure you can afford it. If you’re still working, you may consider opening a Roth IRA to make sure that some of your retirement funds are free from required minimum distributions in the future.

Finally, if you’re past the age for RMDs but are still working, you don’t have to take distributions from your employer-sponsored 401(k). This only applies to the retirement plan for your current employer, but many people take advantage of this exception if they are still on the job.

Are your retirement funds set up in the best way to meet your future goals? If you’re uncertain about the impact that required minimum distributions will have on your plans, we can help. Contact us for retirement planning help today!

No doubt about it: College is expensive. Right now, the average cost per year is $35,331*. Multiply that by a couple of children and four to six years to complete a degree, and you may feel heart palpitations coming on.

So what’s a family to do to try to pay for it all?

One important savings vehicle is a 529 Plan, which is designed specifically for college and other educational expenses. This is a tax-advantaged plan that can help you grow your savings faster, but there are some important rules to know about before you dive in.

Here’s what you need to know.

529 Basics

529 plans were launched in 1996 to help families save for college. Though originally designed only to pay for college costs, today you can use 529 earnings to pay for tuition from kindergarten through graduate school. When you contribute to a 529 account, the money is invested and grows tax-free. As long as the money you withdraw from the account is used for qualified educational expenses, you will never be taxed on the earnings. This allows your money to grow faster.

529 plans are sponsored by individual states, and each state has its own specific rules about the plan. You don’t have to participate in the plan sponsored by your own state, but doing so could come with additional benefits, such as a state tax deduction on your contributions.

Though the details vary by state, there are several major rules to remember when it comes to 529 plans:

- Anyone can open a 529, but you must name a beneficiary. Generally, parents and grandparents open accounts for a specific child. That beneficiary must be named on the account, and withdrawals must be for that beneficiary’s expenses in order to avoid penalties.

- You can change beneficiaries at any time, but it’s best to keep it in the family. Since a 529 can only be used to pay for a single beneficiary’s expenses, you may wish to change who that is. For example, parents may designate a younger sibling when the original sibling has graduated from college. To avoid penalties, new beneficiaries must be a family member of the current beneficiary.

- You can make penalty-free withdrawals to pay for qualified educational expenses. Qualified expenses include tuition, books, supplies, and room and board. You may also pay for K-12 tuition at a private school as well as apprenticeship costs and up to $10,000 in student loan repayments.

- If you withdraw 529 money for non-education purposes, you’ll pay taxes on the earnings, plus a 10% penalty.

529 Benefits and Drawbacks

For many families, a 529 Plan is a great way to save money while avoiding taxes. However, some of the rules limit flexibility and may not be a great choice for everyone. It’s always a good idea to weigh the pros and cons before you invest.

Pros:

- Tax-free growth of your investment.

- Potential for additional tax benefits in your state.

- 529 money is the asset of the person who owns the account, not the beneficiary. This means that it is given less weight when your child fills out their FAFSA to determine financial aid.

- Easy to change beneficiaries to help other children or grandchildren if you have funds left over.

- Many plans are designed with a target year in mind to automatically adjust risk level over time.

Cons:

- If your named beneficiary doesn’t go to college, you’ll need to designate the funds for someone else or take a 10% penalty to access your savings for non-education purposes.

- Likewise, if your child gets a substantial scholarship or you save too much money in a 529 Plan, you’ll need to decide whether to designate a new beneficiary or take the penalty to use the funds for something else.

- If you build college savings at the expense of your retirement, you could be in a precarious position for the future.

Alternatives to a 529 Plan

If you’re uncertain about using a 529 Plan and locking your savings into education spending, there are several other ways to save for college. You might consider:

- A Brokerage Account: This provides maximum flexibility on your investments, and there are no limits on contributions or withdrawals. You will, however, be fully taxed on the earnings each year.

- A Coverdell ESA: Like a 529, a Coverdell ESA is a tax-advantaged plan, but you have more freedom to control how the money is invested. There is an annual contribution limit of $2,000, and eligibility phases out for higher earners.

- A Roth IRA: A Roth IRA is a tax-advantaged retirement plan, but it does allow you to withdraw funds to pay for college without penalty. This allows greater flexibility in how you use the funds, but if you spend your whole Roth on college, you’ll need other retirement savings to secure your own future.

It can be a real challenge to balance saving for college and saving for retirement. We can help make sure you’re on the right track! Contact us today for insight on how to develop a comprehensive financial plan that works for your whole family.

State tax laws and treatment may vary. Earnings on non-qualified distributions may be subject to income tax and a 10% federal penalty tax. Please consult your tax adviser for more information.

*https://educationdata.org/average-cost-of-college

Your grandfather may have worked for the same company from the day he graduated high school until his retirement at age 65, but today, most of us will work for several different employers over the course of a career. By the time a current Baby Boomer retires, they’re likely to have held 12 different jobs.

With all of those jobs comes a patchwork of retirement benefits. No two employer packages are the same, and each time you switch jobs, you’ll have to decide what to do with that 401(k) account moving forward. Fortunately, you don’t have to keep track of a dozen different accounts — rollovers let you combine your retirement money to make managing it much easier.

But there are rules to follow. Here’s what you need to know.

What is an IRA Rollover?

An IRA rollover is the process of shifting funds from one type of retirement account to another. For example, a traditional 401(k), 403(b), or TSP is tax-advantaged, and you only have to pay taxes when you take money out of the account.

But technically, closing an old 401(k) would look exactly like taking all the money out of it. So to make sure that everyone follows the rules and pays the correct amount of taxes on the money, you are required to complete some paperwork that proves you actually put all the money from one retirement account directly into another one. This is the rollover process.

The whole point of a rollover is to avoid having to pay taxes on your retirement money just for moving it around. It also means you avoid paying a 10% penalty on that money if you are under age 59½.

A quick technical note: An IRA rollover describes the process of moving money from one type of retirement account to a different type of account. For example, you may wish to rollover an old 401(k) into a personal IRA when you retire or switch jobs so that you have greater control over your investment options (instead of being limited to the choices provided by your employer). An IRA transfer, on the other hand, is the process of moving money between two retirement accounts of the same type. For example, you could transfer the money from one 403(b) to another when you change jobs. Both processes are designed to shelter you from any tax consequences or penalties, provided you follow the rules.

Rules for Tax-Free Rollovers

First, you’ll need to open a personal IRA account if you don’t already have one. Your money needs somewhere to go when you roll it over, so this is the first step. When you do this, decide if you want a traditional or a Roth IRA. If your goal is to pay no taxes, you’ll need to choose a traditional IRA: Money moved from a traditional 401(k) to a Roth IRA will be taxed at your regular income rate, which could leave you with a much bigger tax bill than you anticipated.

Next, you’ll initiate the rollover. There are three ways to do this:

- Trustee to Trustee Transfer: Also known as an in-kind transfer, this can be done if you are moving money from one type of account to the same type of account with a different bank. It’s the easiest to accomplish, since your current bank will send the money directly to the new one. There’s no extra reporting to the IRS and no withholding of taxes.

- Direct Rollover: In this type of rollover, your current retirement plan administrator will send your money directly to your new plan. In some cases, you might get a physical check made out to your new bank and have to do the mailing yourself. But since your name is not on the check, no taxes are withheld, and the process is much easier. At the end of the year, you’ll receive a 1099-R form to report on your taxes, but you will not owe any taxes as long as the amount on the form matches the amount you deposited into your new retirement account.

- 60-Day Rollover: With this type of rollover, your plan administrator sends you a check for your funds. This check is in your name, and you have 60 days to deposit it into a new account to avoid taxes and penalties. If you’re moving funds from a 401(k), your plan administrator is required to withhold 20% of the amount for taxes (though you will eventually get this back). You’ll receive a 1099-R form to report the transaction to the IRS when you file your income taxes.

Rollover Mistakes to Avoid

Most rollovers go off without a hitch, but you do need to be careful about the paperwork. Avoid these mistakes so you don’t get stuck with a big tax bill:

- Choosing a 60-Day Rollover: If a trustee to trustee transfer or direct rollover is available to you, take it! It’s the best way to avoid tax withholding or an accidental bill from the IRS if you miss the 60-day deadline.

- Missing the 60-Day Rollover Window: If you must have the check sent to you in your name, send it to your new plan administrator for deposit right away. Some people wish to borrow from themselves during this 60-day period (i.e., temporarily using a portion of the IRA funds before completing the rollover), but this is only appropriate if you are absolutely certain you can pay the full amount into your new retirement account by the deadline.

- Rolling Over Into a Roth Without Planning for Taxes: You can roll funds into a Roth IRA, but you’ll have to pay taxes on the full amount at your regular income rate next April. This can be a solid strategy for retirement overall, but you’ll need to plan ahead for the bigger tax bill to avoid a shock.

- Failing to Report Your 1099-R: You should receive this form automatically from your plan administrator, so plan to contact them if you don’t. You’ll need to remember to report the amount on the form as miscellaneous income on your taxes — though if all the numbers match up, you won’t owe anything.

The Bottom Line

Consolidating your retirement accounts into one easily managed IRA makes a lot of sense for most people. As long as you are careful to follow the rollover rules, you can avoid taxes and penalties as you get your financial house in order. And if you need more advice about how to make sure you’re saving enough, we’re here for you! Contact us today to get started on the right retirement plan for you.

Maybe your grandparents gave you a savings bond each year for your birthday when you were a kid. Maybe you received a pile of paper bonds as part of an inheritance. Or maybe you bought a savings bond or two as a safe way to invest, but forgot about them when life got busy.

If you’ve got old savings bonds lying around, they’re definitely worth something. Here’s how to know what you’ve got — and what to do with them.

A Savings Bond Primer

First, a quick lesson on US savings bonds. Savings bonds are one way that the federal government borrows money to keep the country running. In this case the government is the borrower, and you, the savings bond owner, are the lender. When you buy a bond, you are lending the government money that they will repay with interest over time. When the bond matures, you get back your initial investment plus all the interest the government pays for the privilege of borrowing from you.

Because savings bonds are guaranteed by the United States Treasury, they are one of the safest investments around. You may not earn a huge interest rate, but you can be very confident that — unlike a tech startup or even a major corporation — it will always be around to honor its debt and pay you back.

Savings bonds can be given as gifts, and they were hugely popular a few generations ago as a way to provide a good start for children and grandchildren. Because bonds take 20 to 30 years to mature, people felt good about giving them to children so they could have a nice little nest egg to pay for college or buy a house when they became young adults.

Of course, many people also buy savings bonds for themselves as well. Nowadays it’s all done online and bond certificates are electronic instead of paper, but the concept is the same.

How to Tell When Your Bond Is Mature

If you have bonds, you’ll get the most out of the investment if you wait until they are fully mature to cash them in. This depends on the bond’s purchase date and series, both of which are listed on the front of the bond.

Start by checking the series of your bonds. If you have Series E or Series H bonds, these are already mature and no longer earn interest. You can cash these in for maximum value at any time.

If you have Series EE, Series HH, or Series I bonds, you’ll need to check the date, as some of these have matured while others have not. Series EE and Series I bonds earn interest for 30 years, while Series HH bonds earn interest for 20 years. You can check the Treasury Direct website for additional information about other, less common bond series as well.

If you’re not interested in maximizing the return on the bond, you can always cash it out early. As long as the bond is more than five years old, you can do this without penalty. Still, if at all possible, it’s best to wait until the bond is fully mature to get the full return when you redeem it.

How to Redeem Your Bonds

Most, though not all, banks will cash savings bonds for their customers. Call ahead to make sure they offer this service. When you go to the bank, you’ll need to bring your savings bonds as well as your ID. The bank will check to make sure the bonds are issued in your name — you won’t be able to cash them if they’re in someone else’s name.

If your local bank doesn’t cash bonds, you can mail them to the US Treasury instead.

Note that if you received bonds as part of an inheritance, the bond is considered part of the estate to be settled. You’ll have to do some additional paperwork to redeem the bond.

If your bonds are electronic, you can track their value and cash them in online at Treasury Direct. From there, you will receive a direct deposit for the amount you are owed.

Don’t Forget Taxes

Discovering forgotten savings bonds can be exciting, but be careful: As the owner of the bond, you are on the hook for income taxes on any interest you have earned. Bonds are taxed in the year that you redeem them, so expect to receive a 1099-INT form in the mail. You’ll then enter this information when you file your federal income taxes, just as you would when you earn interest on a regular bank account.

If you have a large amount of money in savings bonds, it’s a good idea to set some aside to cover the taxes so you aren’t caught off guard by a surprise bill in April. You may also reduce your tax burden by using your bond proceeds to pay for qualified higher education expenses. There are age and income limitations, so be sure to check the rules or talk to your tax professional for additional help.

How to Reinvest Your Savings Bond Earnings

Unlike other treasury bonds and notes, there’s no automatic reinvestment for savings bonds. Once you cash them in, you have to manually buy a new savings bond if you’d like to reinvest. You can do this online at Treasury Direct. Because this process is a bit clunky, you will still owe taxes on the interest, regardless of whether you buy new savings bonds or use the money for something else.

For more help with your investments or advice about what to do with an unexpected windfall, please reach out! We’re always here for you.

Past performance doesn’t guarantee future results. The views and material presented were created and intended to provide background assistance and education only.

The housing market is red-hot right now, thanks to continued low interest rates and plenty of demand. That’s understandable, as the world is opening back up and people have a much clearer idea of how they want to live their post-pandemic lives.

It’s a seller’s market right now, and if a move makes sense for you — particularly if you’re downsizing — you could walk away with a tidy profit. But what would making a killing on a home sale do to your tax situation?

Your house is an investment, so selling it for a profit could leave you with a tax bill on the gains. Unlike selling stocks or bonds, however, there are important capital gains exemptions when you sell your primary residence. Here’s what you need to know.

What Are Capital Gains?

Capital gains are the profits you earn when you sell an investment for more than its purchase price. Your home is a major investment — probably the largest you will ever make — and selling often results in a profit, as real estate values historically tend to rise over time. Capital gains are also earned on other types of investments, including stocks, bonds, and occasionally property like a classic car or collectibles.

Capital gains are taxed by the IRS according to a specific set of rules. Short-term capital gains (profits on investments held for less than one year) are taxed at your ordinary income tax rate. Long-term capital gains are taxed at 0%, 15%, or 20%, depending on your income and whether you’re filing single or jointly.

While those rates apply for most investments, the sale of your home is different, and you may qualify for a big tax break on those capital gains.

How Are Home Sales Taxed?

To give homeowners a break when they sell their largest investment, the IRS has carved out a significant capital gains exclusion when you sell your primary residence. Single filers may be exempt from paying capital gains taxes on the first $250,000 of profit from a home sale, while married filers may exclude up to $500,000 of profits.

For example, if you are a single person who bought your home for $200,000 and later sold it for $400,000, you made a profit of $200,000. That amount falls within the exclusion, so you would owe no tax on your profits.

This is a huge tax break for most people! If you’re married, you could enjoy a tax-free gains of up to $500,000 if your home has risen significantly in value.

How to Qualify for the Tax Exclusion

There are specific rules you have to follow in order to qualify for this big tax exclusion. To have all of the capital gains taxes forgiven, you must:

- Have owned the home for at least two of the last five years

- Have used the home as your primary residence for at least two of the last five years

- Not have claimed the capital gains exclusion on another property within the past two years

- Not have acquired the property through a 1031 exchange

- Not be subject to expatriation taxes

Note that you do not have to live in the home as your primary residence for two consecutive years. As long as you lived there for a total of two years out of the last five, even if only a few months at a time, you will pass the use test. There are also exceptions for members of the military or who hold certain other government jobs that force them to be deployed overseas.

What Happens If Your Profits Are Over the Limit?

If, when you sell your home, you end up earning more than the allowable amount, you’ll have to pay capital gains taxes on the difference. For example, a single filer who bought their home for $200,000 but sold it a decade later for $500,000 made a profit of $300,000. For a single filer, this is $50,000 over the $250,000 capital gains exclusion amount. That means that this filer must pay capital gains taxes on $50,000.

The amount you pay in capital gains taxes depends on your total income, which includes your salary plus your taxable capital gains. In 2021, if you earn less than $80,000 total, you pay 0% in capital gains taxes.

If your total taxable income is between $80,000 and $441,450 for single filers or between $80,000 and $496,600 for married filers, you pay 15% in capital gains taxes. For filers over those limits, capital gains are taxed at 20%.

How to Reduce Your Capital Gains Exposure

If your home value has increased significantly since you bought it, you may still be able to make an adjustment to reduce the capital gains taxes you pay. If you made improvements to your home — i.e., remodeling, additions, or other major improvements like a new roof — you can add the cost of these investments to your cost basis.

For example, suppose our single filer who bought their home for $200,000 built an addition for $50,000 before selling the home for $500,000. This homeowner can add the $50,000 expense to the $200,000 cost basis for an adjusted basis of $250,000. That means their official profits are now only $250,000, which is within the limit and therefore tax free.

Even if you can’t wipe out all of your capital gains by offsetting home improvements, you may be able to reduce what you owe. The lesson? Save all those receipts! You’ll need good records or your improvements to successfully adjust your cost basis.

The Bottom Line

Selling your home can lead to a large capital gain — and one that’s largely tax free. As long as you’ve owned and lived in your home for two of the past five years and haven’t claimed another exclusion in that time, you can enjoy a major tax break. Keep track of all your expenditures on improvements to help make sure your profits stay within the limits, and you’ll likely avoid paying all or most of the capital gains taxes when you sell your biggest investment.

Individual Retirement Accounts (IRAs) are a cornerstone of retirement planning for people who don’t have employer-sponsored plans, but did you know that many people with a 401(k), 403(b), or Thrift Savings Plan (TSP) are also eligible to contribute?

If you’ve been thinking about boosting your savings, an IRA could be the perfect way to turbo-charge your retirement plan. Best of all, there’s still time to take advantage of those tax benefits for 2020 if you haven’t filed yet. Here’s everything you need to know about these tax-advantaged accounts.

Traditional IRA 101

A traditional IRA is a savings plan that allows you to build a retirement nest egg without paying taxes on dividends, interest, and other earnings. This means your wealth can grow more quickly than in a standard brokerage account, which is subject to capital gains taxes each year. This is a big benefit designed to encourage people to save for retirement in a world where pensions are no longer available for most workers.

Even better, your contributions to a traditional IRA are tax-deferred, which means you do not have to pay taxes on the money you contribute. When you file your taxes, you can deduct the amount of your contributions from your taxable income, which will lower your tax burden for the year. You will, however, pay taxes on distributions you take from your traditional IRA once you retire.

You may begin distributions without penalty at age 59½; you must begin to take required minimum distributions by age 72.

Roth IRA 101

A Roth IRA is another type of retirement account with important tax advantages. Like a traditional IRA, the earnings on stocks, bonds, and other investments in the account are not taxed, which helps you build wealth at a much faster clip.

What makes a Roth IRA different is that you pay taxes on your contributions upfront, in the year you earn the money. However, you will never pay taxes on that money again, so when you retire, your distributions are tax-free. With good planning, a Roth IRA can help reduce your tax burden in retirement and make your savings go farther.

Roth IRAs come with a few additional advantages. Because you already paid taxes on your contributions, you can take out what you put in at any time — the only penalty comes for taking out earnings before age 59½. There are also no required minimum distributions, so you can pass on your Roth IRA to your heirs when you die.

Contribution Rules

With such great benefits, it’s no surprise that there are contribution limits to both traditional and Roth IRAs. For the years 2020 and 2021, the contribution limit for both traditional and Roth IRAs is $6,000 per year. Once you turn 50, you can contribute $7,000 annually.

Note that Roth IRAs have an additional phase-out of eligibility based on income. In 2020, single filers with a modified adjusted gross income between $124,000 and $139,000 will have a reduced contribution amount, and those with a MAGI over $139,000 are not eligible to contribute. For married joint filers, contributions are reduced for those with a MAGI between $196,000 and $206,000. Those with a MAGI over $206,000 are ineligible.

You can make contributions to either type of IRA right up until the tax filing deadline for that year. This means that people with a traditional IRA can make a final contribution as they calculate their taxes, allowing them to lower their taxable income at that last minute if they haven’t maxed out their contributions. This is especially handy if you’re close to crossing into the next tax bracket and want to stay below the threshold.

Who Can Contribute to an IRA?

Anyone with earned income can contribute to an IRA. This includes teens with babysitting jobs, the self-employed, and anyone working a side gig for extra income. It should be noted, however, that Social Security checks and pension payments are not considered earned income, so you’ll need to take on at least a part-time or seasonal job to contribute if you retire early.

You can also contribute to an IRA if you already have an employer-sponsored 401(k) or TSP but there are some caveats when it comes to deducting your IRA contributions if you participate in both plans. It is always best to consult with a tax advisor. However, this can be a good way to diversify your investments by having both a traditional and Roth-style plan, which lets you ease some of your tax burden both now and in retirement.

Finally, a non-working spouse can also have an IRA. The Spousal IRA is the exception to the rule about needing earned income and allows the working spouse to contribute to an account on the non-working spouse’s behalf. The Spousal IRA is in only one person’s name and is not a joint account.

Extra Credit: The Backdoor Roth

If you are a high earner whose MAGI is above the limit for Roth IRA contributions, there’s still a way to contribute to a Roth each year. This strategy is known as the “backdoor Roth IRA.” This is not a special account, but rather refers to converting money from a traditional IRA or 401(k) into a Roth. Because there are no income limits on traditional IRAs, you can contribute up to $6,000 in that account, then convert it into a Roth any time you wish.

Be aware that when you rollover money into a Roth, you are taxed on that money in the year of the rollover. This means that you should work with a professional to calculate your taxes and make sure that you don’t convert more than you can afford to pay the taxes on in any given year. You’ll also need to wait at least five years before being able to withdraw these converted funds.

Despite the immediate taxes, a backdoor Roth can be a valuable strategy if you’re looking to reduce future taxes during retirement, especially if you think you may be earning much more then — or you’re betting that taxes will go up. It’s also a way to avoid required minimum distributions on some or all of your retirement nest egg to keep your wealth intact for yourself and your heirs.

The Bottom Line

If you haven’t maxed out your IRA contributions for 2020, there’s still time! This year, you have until May 17 to file your taxes and complete any 2020 IRA contributions. And if you don’t have an IRA, now is the perfect time to get started — we can help! Contact us today to make sure your 2020 contributions are made in time.

Medicare is a fantastic benefit that makes it possible for many retirees to enjoy life more fully, thanks to premiums that are far more affordable than market rates on private health insurance plans. Still, Medicare isn’t free, and there are some sneaky extra costs that can blindside you if your income rises above a certain threshold.

Friends, meet IRMAA.

Just as a sudden windfall or boost in your retirement income can bump you into a higher tax bracket, so too can it push you into a higher payment tier for your Medicare Part B and Part D coverage.

Fortunately, unplanned IRMAA expenses can be avoided with careful planning. Here’s what you need to know.

Understanding IRMAA

IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some people’s Medicare premiums. While most people who receive Medicare benefits when they reach age 65 will never have to worry about IRMAA, those with higher incomes are charged extra each month for their coverage.

IRMAA charges affect premiums for Medicare Part B (medical insurance) and Part D (prescription drug coverage) plans. If you have a Medicare Advantage plan, you will also be subject to IRMAA charges on the affected portions of the plan.

IRMAA charges are based on your yearly income as reported on your tax return. Specifically, the Social Security Administration (SSA) uses your Modified Adjusted Gross Income (MAGI) for its calculations.

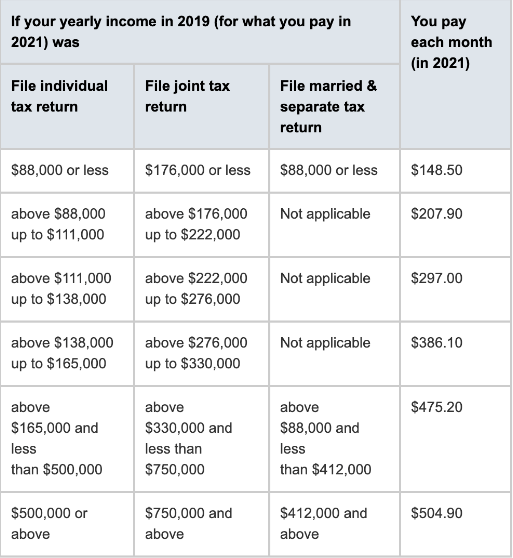

For this year, anyone earning less than $88,000 filing single or $176,000 filing joint will not have an IRMAA charge: your monthly premium is the standard $148.50 per person, per month.

However, if you earn more than that, you will be charged extra based on your income bracket:

Souce: medicare.gov

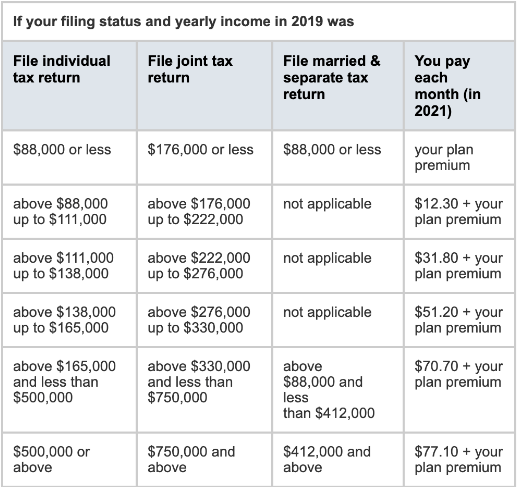

Likewise, you will also be charged extra for Part D coverage, following the same income brackets:

Source: medicare.gov

Why IRMAA Can Be Tricky

When the SSA determines your IRMAA charges, they use your MAGI from two years prior to the year in question. For example, premiums for 2021 are based on the income from your 2019 tax return.

This means that decisions you make could come back to haunt you in the future.

For example, if you sell some real estate and earn a profit, that money could push your income into a higher tax bracket and a higher IRMAA bracket. While you’ll pay income taxes on the proceeds relatively quickly, the IRMAA charges will be delayed, which leaves you open to a budget shortfall if you’re caught off-guard.

The income thresholds for IRMAA brackets are also subject to change each year, making it harder to plan ahead. That’s because IRMAA thresholds are no longer frozen but instead tied to inflation using the Consumer Price Index. You can make an educated guess about next year’s premiums and IRMAA thresholds before official numbers are published, but you’ll want to pad this number to avoid an unpleasant surprise.

Finally, major life events can have a big impact on your income, and this can in turn affect your IRMAA charges in the future. Fortunately, the SSA will consider an appeal if your circumstances have changed and your income is significantly lower than it was in the tax year used for your determination. Not everything that impacts your income is officially recognized, but these events could help your appeal:

- Death of a spouse

- Divorce or annulment

- Loss or reduction of a pension

- Loss of property that generates income

- Marriage

- Settlement payments from an employer

- Unemployment or reduced hours/income

Tips for Avoiding an IRMAA Charge

In general, the best way to avoid unwanted IRMAA charges is to make sure your income remains steady throughout retirement. This means remaining just as vigilant about your IRMAA bracket as you are about your marginal tax rates. This is especially important if your income hovers near the top of your current bracket, as you will have less room for error.

Some common income-boosters to be aware of include:

- Selling real estate, especially if you’ve owned it for a long time and it has significantly increased in value.

- Selling investments subject to capital gains taxes. These transactions typically occur outside of your IRA or 401(k) in brokerage accounts.

- Converting a traditional IRA to a Roth, which leaves you open to a big tax liability and IRMAA charges on the lump sum, which is considered income.

Another common income-booster comes when you turn 72 and must take required minimum distributions (RMD) from a traditional IRA or 401(k). If you plan carefully, you can reduce other portions of your income so this balances out, or you can consider giving your RMD to charity if you itemize deductions.

Feeling a little dizzy from all the things you have to keep track of in retirement? We’re here to help! A solid financial plan will take into account all of your investments, income streams, and expenses like taxes and IRMAA so you can enjoy the retirement you deserve. Get in touch today to learn more.

One of the biggest expenses in your life is federal income tax. Sure, writing the check for the payment on your home is a major milestone, but most people will end up paying far more than that in taxes over the course of a lifetime.

And yet, you’re probably not paying as much as you think.

You read that correctly! One of the biggest misconceptions people have about their taxes surrounds their tax rates and how they work. And this misunderstanding leads most people to think they owe more than they actually do.

The trouble comes from a complex tax code that uses tax margins to tax different levels of income at different rates. Understanding exactly how this works is crucial for making good decisions about your money.

So let’s clear up the misconceptions and misunderstandings. Here’s what you need to know.

What Is Your Marginal Rate?

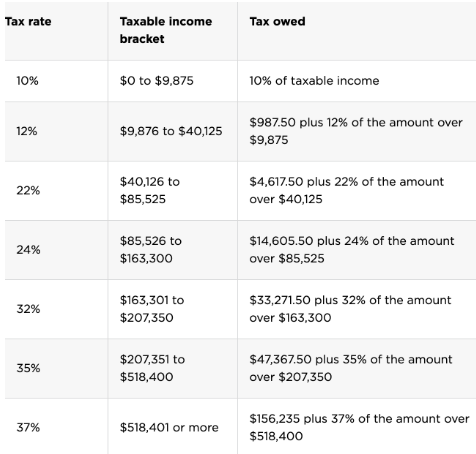

Tax margins are the result of a progressive tax system, in which people with lower income pay taxes at a lower rate, while people with higher incomes are charged more. Higher tax rates kick in when you cross a certain income threshold, creating what we call tax brackets:

Single Filer 2020 Federal Income Tax Brackets

Source: NerdWallet

Let’s look at an example. If a single person earned $45,000 of taxable income in 2020, they’d be in the 22% tax bracket.

But that does not mean they pay 22% in income taxes.

In reality, they only pay 22% tax on part of their income — specifically, the part that kicks them over the $40,125 limit of the 12% bracket.

The best way to understand this is to imagine each tax bracket like a bucket. Everyone’s income is first poured into the 10% tax bucket. But that bucket only holds $9,875. If your taxable income is less than that, then you’re done — you only owe 10% in taxes.

But if your taxable income is more than $9,875, it will spill over into the next bucket. This is the 12% bucket. This bucket holds up to $40,125, so our sample tax payer above has income that will also spill into the third bucket. But the 22% bucket is where he stops, because it holds more than $48,000.

Our taxpayer will pay the taxes on each bucket, meaning he will pay 10% on the $9,875 in the first bucket, 12% on the $30,250 in that bucket, and 22% on the rest — but that 22% bucket only has $4,875 in it.

So while this taxpayer has a marginal tax rate of 22% — the highest bracket he falls into — he won’t pay 22% on all of his money. His effective tax rate is actually lower.

What Is Your Effective Tax Rate?

Your effective tax rate is the percentage of your income that you actually pay in taxes — and this is almost always less than your marginal rate. This is much easier to calculate: just take the total dollar amount you pay in income tax and divide it by your total income.

To see how it works, let’s calculate the effective tax rate for our sample taxpayer. He paid:

- 10% on $9,875 = $987.50

- 12% on $30,250 = $3,630.00

- 22% on $4,875 = $1,072.50

That’s a total of $5,690 in income tax. That means his effective tax rate is:

- $5,690 ÷ $45,000 = 0.126, or 12.6%

As you can see, our sample taxpayer doesn’t pay anywhere near 22% on his income — his effective tax rate is only 12.6%.

This is great news, and it should hopefully lay to rest the myth that being pushed into a higher tax bracket suddenly takes all your money away, or that you could actually end up owing all the extra money you earn, making it somehow not worth getting a raise. This is simply not true.

Using Your Marginal and Effective Tax Rates to Make Good Decisions

Your effective tax rate is a snapshot of your total tax burden, which can be useful in monthly and yearly budgeting. For example, freelancers and other workers with 1099 income with no tax withholding can use their effective tax rate to plan ahead and avoid a shock when their tax bills are due in April. The same is true for retirees who want to have a clear understanding of what they’ll owe on their IRA distributions.

Your marginal tax rate, on the other hand, is important for making strategic retirement decisions. That’s because any additional tax deferred retirement account (IRA, 401k, 403b, TSP, 457) income you withdraw will be taxed at your marginal rate — that is, your current “bucket” that you’ve worked your way up to. If you have flexibility about taking a distribution now or later, using your marginal rate to compare options will give you a more accurate view of what those changes will cost and can help you save money in the long run.

It should be noted that these calculations can get complicated. For example, you might want to figure your state taxes into your effective tax rate, or you may need help calculating an accurate marginal tax rate if some of your strategies push you into a higher bracket. We’re here to help! Tax planning is a crucial part of financial planning, so please get in touch if you have additional questions about how your marginal and effective tax rates impact your retirement plan.